By

Reuters

Reuters

Published

Feb 11, 2011

Feb 11, 2011

Taubman Q4 FFO beats Wall St forecast

By

Reuters

Reuters

Published

Feb 11, 2011

Feb 11, 2011

Feb 11 - Luxury mall operator Taubman Centers Inc reported higher-than-expected earnings, helped by lower property expenses, a rise in sales, and improved occupancy and rental income.

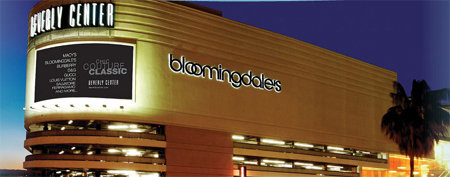

Beverly Center, a shopping centre owned by Taubman |

Luxury retailers, hobbled during the financial crisis and recession, have staged a comeback.

Saks Inc, Nordstrom Inc and Polo Ralph Lauren Corp enjoyed some of the biggest sales gains of all retailers in 2010 as the stock market rally gave well-off shoppers the confidence to splurge on luxury again. French luxury goods maker LVMH Moet Hennessy Louis Vuitton SA racked up a double-digit sales increase as it enjoyed a robust holiday sales.

A portion of those sales become part of Taubman's revenue, but more importantly they indicate where rents are headed.

Stamford Town Center, another one of Taubman's properties |

Sales at the company's malls rose 12.4 percent in the quarter, resulting in sales per square foot of $564 for 2010, an industry record, the company said.

"They upgraded the mix of their portfolio, bringing in more luxury tenants into certain malls," Keefe, Bruyette & Woods analyst Ben Yang said. "That certainly helps raise the price point of merchandising."

Taubman reported fourth-quarter funds from operations (FFO) of $59.6 million, or $1.06 per share, compared with $31.1 million, or 56 cents per share, a year earlier when the company incurred litigation charges.

Analysts on average had expected quarterly FFO of 97 cents per share, according to Thomson Reuters I/B/E/S.

FFO is a real estate investment trust performance measure that removes the profit-reducing effect of depreciation from earnings.

The company, based in Bloomfield Hills, Michigan set a 2011 full-year FFO forecast in a range of $2.86 to $2.98 per share, excluding The Pier Shops in Atlantic City and Regency Square in Richmond, Virginia, both of which the company plans to return to lenders.

Analysts had forecast FFO of $2.77 per share.

Including the effects of those two malls, the company sees FFO in the range of $2.62 to $2.74 per share.

The mall owner also stepped up progress on its entry into the outlet center business, forming a joint venture with a company headed by Bruce Zalaznick, a former executive vice president of Prime Outlets and Chelsea Property Group, two companies bought by Simon Property Group Inc, the largest U.S. mall owner.

Taubman will hold a 90 percent stake in the joint venture for any of the outlet centers they build.

Taubman shares closed down 0.4 percent, or 19 cents, at $52.91 before its results were released and traded at $52.95 after hours.

(Reporting by Ilaina Jonas; Editing by Phil Berlowitz)

© Thomson Reuters 2024 All rights reserved.