Jun 10, 2015

LVMH still at the head of Deloitte 's luxury ranking

Jun 10, 2015

French groups continue to dominate the luxury market, but new protagonists like the Chinese jeweler are picking up speed and closing the gap. These are the conclusions that can be drawn from the data in the Global Powers of Luxury Goods ranking by professional services firm Deloitte, on the one hundred largest luxury goods companies in the world.

Three of the Top 10 companies are luxury conglomerates participating in multiple luxury categories with multiple luxury brands; two are cosmetics and fragrance companies; two are jewelry and watch companies; two are apparel companies; while Luxottica is the only accessories company. The U.S. and France are each headquarters to three of the Top 10, Switzerland has two, and Italy and Hong Kong, one each.

This second edition establishes a ranking of players in the luxury sector based on their revenue from the 2013 financial year, which amounts to 214.2 billion dollars altogether for these 100 leading companies, active in ready-to-wear, accessories, high end jewellery and watches, as well as cosmetics and perfume.

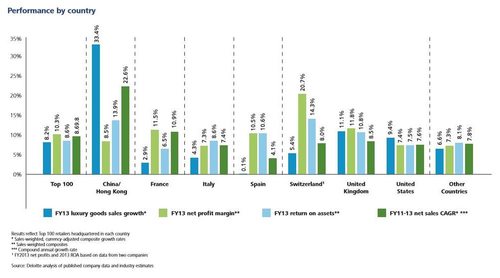

The ranking shows a strong resistance in the global luxury industry, with an average 8.2% growth in revenue in 2013 compared to +5.6% for the top 250 consumer goods companies. It does however also show that growth was slower than in 2012, when it stood at 12.6%.

It is the world's leading luxury house, LVMH, which counts Louis Vuitton, Fendi and Céline in its portfolio, that is at the head of the ranking, with revenue at 21.7 billion dollars, followed by Swiss group Richemont (13.4 billion) and Estée Lauder (10.9 billion), exactly like the first ranking published by Deloitte last year.

The surprise comes in at fourth place, held by Chinese watch and jewellery group Chow Tai Fook, which has made a remarkable entrance on the top 10 list of the leading luxury groups which alone represent 48.9% of the total revenue of the top 100. The Tiffany & Co of Asia generated 9.9 billion dollars in sales in 2013, jumping 34.8% compared to 2012.

With the drop in the price of gold and the multiplication of its points of sale, the group has literally exploded, like many of the new Chinese entries in the top 100, which are all active in the jewellery-watch sector and exclusively oriented at the internal market," says Bénédicte Sabadie, an associate responsible for the luxury sector at Deloitte.

Another new entry to be pointed out in the top 10 is the American group PVH (Tommy Hilfiger, Calvin Klein, etc.), which fills the number ten spot, following the acquisition of its subcontractor Warnaco. Shiseido and Rolex, which were respectively in 9th and 10th place last year, have fallen out of the top 10.

The others are still there though, just one place back compared to last year: Luxottica and Swatch in 5th and 6th place, followed by Kering, L’Oreal and Ralph Lauren.

With an average rate of 33.4%, the luxury companies from China and Hong Kong saw the strongest growth in 2013 and are at the top of the ranking per country. Followed by France. Three of the ten largest luxury groups in the world are indeed French.

In France, the players in the sector saw one of the lowest growth rates in 2013 (2.9% compared to 19.4% in 2012). However, they do have the highest average revenue (4.5 billion). In addition, "the French groups have a better than average performance with superior profitability, or a net profit margin of 11.5%, compared to the 10.3% average for the top 100 as a whole," points out Bénédicte Sabadie.

The third country in the ranking is Italy, which, with 29 companies, generates 16.5% of the top 100 total revenue.

Finally, the ranking of the top ten luxury groups according to their Q ratio, which is "the ratio of a publicly traded company’s market capitalization to the value of its tangible assets," is Christian Dior Couture, followed by L’Oréal, Kate Spade, Pandora, Hermès, Michael Kors, Titan Company, Salvatore Ferragamo, Hugo Boss and Mulberry.

Copyright © 2024 FashionNetwork.com All rights reserved.